Get the free form 8635

Show details

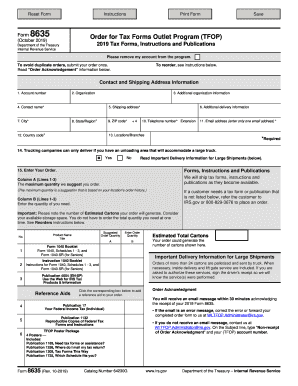

Enterprise. irs. gov On the Subject line type TFOP Order Attach your saved Form 8635 PDF to the e-mail No message text is needed 4. Reset Form Form Instructions Print Form Save / Order Tax Forms Outlet Program TFOP Order Form Rev. July 2009 2009 Tax Year Products Department of the Treasury Internal Revenue Service Contact and Shipping Address Information To make corrections highlight entire box and type over current information To place a reorder...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 8635

Edit your order irs forms form online

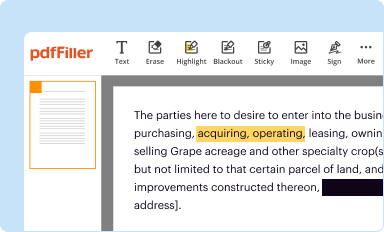

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

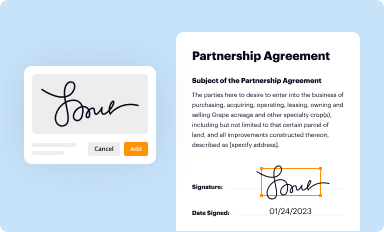

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

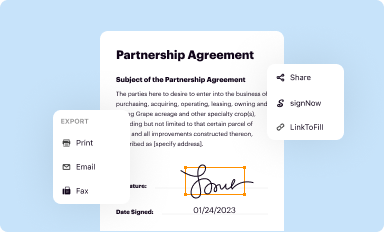

Share your form instantly

Email, fax, or share your form 8435 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

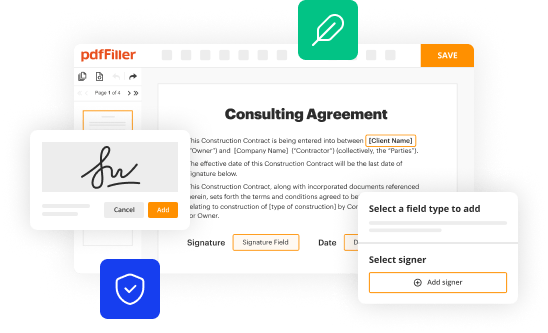

How to edit form 8635 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 8635. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8635

How to fill out form 8635:

01

Start by carefully reading the instructions provided with the form. It is important to understand the requirements and any specific information that needs to be provided.

02

Begin by entering your personal information in the designated fields. This may include your name, address, contact details, and any relevant identification numbers.

03

Fill out the sections of the form that require specific information. This may involve providing details about your employment, income, or any other relevant financial information.

04

If the form requires supporting documents or attachments, ensure that you gather and include them as per the instructions. These may include copies of tax returns, pay stubs, or any other documentation that supports the information provided on the form.

05

Double-check all the information you have entered to ensure accuracy. This includes verifying that all numbers and spellings are correct, and that you have included all necessary information.

06

Once you have completed filling out the form, review it one final time to ensure that nothing has been missed or overlooked. Make any necessary corrections before submitting it.

Who needs form 8635:

01

Form 8635 may be required by individuals who are seeking to claim the health coverage tax credit (HCTC). This credit is designed to help eligible individuals and their family members afford qualified health insurance coverage.

02

In order to be eligible for HCTC, one must meet certain criteria, such as being either a TAA (Trade Adjustment Assistance) recipient, a PBGC recipient, or a person receiving ATAA (Alternative Trade Adjustment Assistance) benefits.

03

Form 8635 is used to apply for the HCTC and provide the necessary information to determine eligibility for the credit. It helps the IRS assess if an individual qualifies for the credit and the amount they are eligible to receive.

04

If you believe you meet the requirements for HCTC or have received notification from the IRS about your eligibility, you may need to fill out form 8635 to claim the credit. It is important to consult the instructions provided with the form or seek professional assistance if you have any questions or are uncertain about the process.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8635 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form 8635 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify form 8635 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your form 8635 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the form 8635 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your form 8635 in seconds.

What is form 8635?

Form 8635 is a document utilized for the reporting of specific information related to the pre-registration or registration process of certain activities associated with the Internal Revenue Service (IRS) regulations.

Who is required to file form 8635?

Individuals or organizations that are involved in specific tax-related activities or transactions that are subject to IRS guidelines are required to file Form 8635.

How to fill out form 8635?

To fill out Form 8635, you must provide accurate and complete information as requested, including your personal or organizational details, the specific activity details, and any other required information as outlined in the instructions for the form.

What is the purpose of form 8635?

The purpose of Form 8635 is to ensure compliance with IRS regulations by collecting necessary information related to certain tax-related activities, facilitating proper monitoring and reporting.

What information must be reported on form 8635?

Form 8635 requires reporting information such as personal or business identification, details of the specific activity, and any documentation or supporting data required by the IRS.

Fill out your form 8635 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8635 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.